Small trucking companies face unique operational and risk challenges. Customized insurance solutions offer tailored trucking coverage that goes beyond basic liability protection. By evaluating specific needs like vehicle types, cargo value, and operating territories, these companies can design personalized policies with optimal protections and cost savings. This approach ensures only necessary coverage is paid for, fostering business success and resilience while addressing vulnerabilities in a dynamic trucking landscape.

In the dynamic world of trucking, comprehensive protection isn’t one-size-fits-all. Combining policies offers a powerful strategy for small trucking companies to navigate risks and achieve their goals. This article guides you through understanding your unique trucking business needs, highlighting the benefits of customized insurance tailored to your fleet. From assessing risks and setting priorities to exploring flexible solutions, discover how personalized trucking policies can maximize protection while minimizing costs, ensuring peace of mind on the road ahead.

Understanding Your Trucking Business Needs: Assessing Risks and Goals

Understanding Your Trucking Business Needs is a critical first step before combining policies for comprehensive protection. Small trucking companies face unique challenges, from managing a small fleet to ensuring the safety and integrity of their cargo. Assessing risks involves evaluating factors like driver behavior, vehicle condition, route safety, and potential environmental hazards. Setting goals should align with these assessments, focusing on areas where vulnerabilities exist – be it cargo damage, liability claims, or regulatory non-compliance.

This strategic approach allows for the development of a tailored trucking coverage plan that goes beyond one-size-fits-all insurance solutions. Personalized trucking policies cater to specific needs by incorporating flexible elements such as customized limits, specific exclusions, and endorsements. Ultimately, small fleet insurance solutions that are thoughtfully designed offer not just liability protection but also peace of mind, ensuring your trucking business is shielded from unexpected events with a robust, yet adaptable, safety net.

The Benefits of Customized Insurance for Small Trucking Companies

For small trucking companies, a one-size-fits-all approach to insurance often doesn’t cut it. Customized insurance tailored to their unique needs offers several significant advantages. By working with insurers who understand the specific challenges and risks associated with the trucking industry, businesses can access more comprehensive and flexible coverage options. This means personalized trucking policies that take into account factors like fleet size, cargo types, driving distances, and safety records.

Such tailored trucking coverage goes beyond basic liability and property protection to include specialized protections for cargo insurance, physical damage to vehicles, and even business interruption in case of accidents or natural disasters. This level of customization ensures small trucking companies are not only adequately protected but also have the flexibility to adapt their insurance plans as their businesses grow and their risk profiles evolve.

Tailoring Trucking Coverage: Creating a Personalized Protection Plan

In the dynamic world of trucking, where each operation is unique, one-size-fits-all policies often fall short. Small trucking companies, with their diverse needs and specialized operations, require flexible insurance plans that cater to their specific requirements. This is where tailored trucking coverage steps in as a game-changer for business owners looking to safeguard their assets and maintain uninterrupted services. By working closely with insurance professionals, fleet managers can create personalized protection plans that align perfectly with their day-to-day operations and future goals.

A customized insurance plan for small trucking companies involves a deep understanding of the business, including factors like vehicle types, cargo being transported, driver experience, and safety records. This information allows insurers to design comprehensive policies that cover everything from liability and collision to cargo insurance, ensuring that every aspect of the trucking operation is protected. Tailored trucking coverage not only offers peace of mind but also provides significant cost savings by eliminating unnecessary coverage and focusing on what truly matters for the business’s success and longevity.

Flexible Solutions for Small Fleet Insurance: Maximizing Protection, Minimizing Costs

Many small trucking companies face a unique challenge when it comes to fleet insurance: balancing comprehensive protection with cost-effectiveness. Fortunately, there are flexible solutions available that allow for customized insurance plans tailored to meet the specific needs of each trucking business. By evaluating their operations and risks, these companies can design personalized trucking policies that offer optimal protection while keeping expenses manageable.

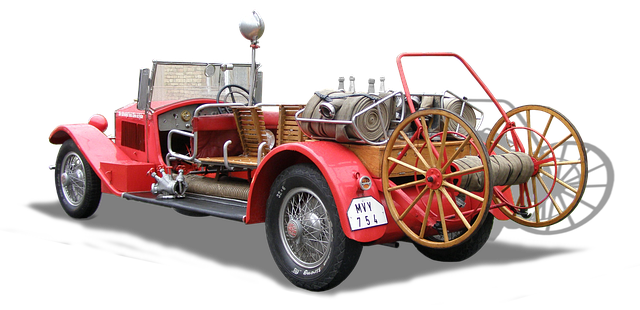

This approach leverages the understanding that no two small fleet insurance needs are identical. With tailored trucking coverage, businesses can select specific types of protection based on factors like vehicle types, cargo value, and operating territories. For instance, a company specializing in local deliveries might prioritize liability insurance and cargo protection for their smaller vehicles, while a long-haul carrier would focus more on comprehensive coverage and roadside assistance for its larger rigs. This level of customization ensures that small trucking companies pay only for the aspects of insurance they genuinely require, maximizing value and minimizing costs.

Combining policies to create a comprehensive protection plan is a strategic move for small trucking companies. By understanding their unique business needs and tailoring their coverage, they can navigate risks effectively while staying within budget constraints. Customized insurance solutions allow for flexible planning, ensuring that each aspect of the trucking operation, from vehicles to cargo, is secured. This approach maximizes protection and provides peace of mind, enabling small fleet owners to focus on growth and success in today’s competitive market.